Can Heir Property Be Sold in Knoxville, TN? Guide to Sell Inherited Property in Tennessee

Key Highlights

- Heir property involves shared ownership without a will, which complicates sales due to the multiple interests of the heirs.

- Partition actions may resolve heir disputes, allowing for the sale or division of legal property under court supervision.

- Navigating Tennessee’s probate and estate laws is crucial to managing the sale of inherited property effectively.

- Knoxville’s robust real estate market offers quick sales and favorable offers for inherited properties.

- Enhancing curb appeal and strategic market analysis maximizes estate value in Knoxville’s competitive market.

Understanding Heir Property and Its Challenges in Tennessee

Heir property in Tennessee is a unique and often complicated form of inherited real estate that can create challenges for beneficiaries. It typically involves property passed down without a will, leading to joint ownership among multiple heirs. This can result in disputes and make selling the property more difficult. Understanding these complexities is crucial for anyone handling inherited property in Knoxville, Tennessee. In the following, we’ll explore the common challenges heirs face when selling and provide guidance on avoiding pitfalls, including how our process works to simplify selling inherited homes.

| Heir Property Characteristics | Challenges in Selling | Potential Solutions |

|---|---|---|

| Multiple Ownership | Consensus Required Among Owners | Utilizing Legal Mediation |

| Lack of a Single Title Holder | Legal Complications | Title Clearing Services |

| Generational Ownership Transfer | Inheritance Disputes | Family Agreements |

| Absence of a Clear Succession Plan | Unmarketable Title | Establishment of Heir Property Services |

This table highlights the complexities and potential resolutions involved in managing heir property in Tennessee.

What is Heir Property in Tennessee?

In Tennessee, heir property is often passed down without a formal will or estate plan, creating tenancy among the heirs. Without a clear owner, each heir holds an undivided interest in the property, which can make decisions such as selling the home more complicated. Inherited property is frequently shared across multiple generations and extended family members, each with their own legal claim. This lack of a structured succession plan, especially in urban areas like Knoxville, can make navigating sales challenging. For heirs looking to simplify the process, connecting with investor home buyers in Nashville and other cities in Tennessee can provide a straightforward solution for selling shared property efficiently.

The inherited property title is typically not transferred entirely to an individual, but rather shared by several parties, necessitating unanimous consent for decisions such as selling. Disagreements among heirs are common, especially when some prefer to sell and others want to keep the property. Another complication is that heirs frequently live far apart, which makes communication and decision-making difficult. Furthermore, financial obligations like property taxes, maintenance, and repairs become joint responsibilities, which can be burdensome. Understanding heir property mechanics is crucial for managing complexities and ensuring a smooth transition if the heirs decide to sell the property.

Common Challenges Faced by Heirs Looking to Sell

Selling heir property in Tennessee presents numerous challenges, primarily due to joint ownership among heirs. One of the most difficult tasks is reaching an agreement. The sale of heir property typically requires unanimous consent, which can be difficult to obtain. Individual priorities, such as emotional attachment or financial necessity, can stymie collaboration. Conflicts can lead to property disputes that require legal intervention, such as a partition action to sell or divide property.

The estate and probate laws in Tennessee present an additional challenge. Inherited property often undergoes probate, which can be a lengthy process and may necessitate court involvement to define the ownership rights of the heirs. Additionally, any remaining estate debts, including mortgages or liens, need to be settled prior to the sale of the property, which could result in a delay in the transaction. Outstanding property taxes and other financial commitments may hinder the sale process. Additionally, heirs are required to present documentation that verifies ownership and the authority to sell, which adds complexity to the transaction.

To effectively address these issues, Tennessee heirs should consult with legal professionals who understand the complexities of inherited property. Proactive planning and open communication among heirs can significantly reduce potential problems, resulting in a smoother transaction. A structured and informed approach not only improves the selling process but also increases the property’s value, ensuring that heirs get the best deal possible in the competitive Knoxville market.

The Probate Process for Selling Inherited Property in Tennessee

In Tennessee, one of the most important steps in selling property acquired from a relative is to go through the probate court. It entails reading the deceased’s will and then appropriately distributing their property. Understanding how Tennessee probate procedures impact the sale can help you avoid legal issues and save time. You do not always need court approval, but it is important to understand when and where it occurs. This section discusses how probate affects real estate transactions and whether heirs always need court approval to move forward. It also discusses the most serious legal issues that Knoxville property owners face.

How Tennessee Probate Affects the Sale Process

Tennessee’s probate process has a significant impact on the sale of inherited real estate. Probate is used to validate an estate plan and confirm the executor, who is responsible for ensuring that the property title is clear and transferable. Debts and taxes must typically be paid prior to the sale. Communication is essential when dealing with multiple heirs because disagreements can cause significant delays and necessitate legal intervention. If there is no will, the property is passed down intestate, and the court appoints an administrator, which complicates and delays the process. Sales are usually prohibited until all estate debts have been paid, and property values can fluctuate during the waiting period, making timing critical.

Preparing the home for sale while also overseeing the probate process is an important consideration. The executor is responsible for determining the accurate value of the property, taking into account repair costs, taxes, and probate fees, as well as ensuring that the transaction is in accordance with state laws. It is strongly advised to consult with legal professionals who specialize in probate cases in Tennessee. This approach will reduce delays, protect heirs’ interests, and increase the final sale price. A successful and profitable probate sale can be achieved with careful planning and timely execution.

Is Court Approval Always Necessary?

Many heirs in Tennessee who want to sell property they inherited want to know if they always need court approval. Probate is the process of making sure that assets are distributed correctly, but not every sale needs a judge’s approval. The need for approval depends on things like how complicated the estate is, how clear the will is, and whether the property is part of a valid and uncontested estate plan. If the will is clear, the heirs agree, and there are no legal problems, court approval may not be needed, which speeds up the sale.

In certain situations, the court must intervene, such as when there are disagreements among heirs, contests regarding wills, unpaid taxes, or existing liens on property. Obtaining court approval ensures that debts are settled and that all parties are protected, particularly in complex estate matters. Tennessee probate law provides a streamlined and adaptable process for qualifying estates; however, it is advisable for heirs to consult with a probate attorney to confirm whether approval is necessary. Engaging a lawyer can expedite the process, prevent costly errors, and ensure that the transaction proceeds efficiently and in compliance with legal standards.

Legal Considerations When Selling Heir Property

To ensure a smooth process when selling their heir property in Knoxville, Tennessee, heirs must take into consideration a multitude of legal factors. When heirs are unable to come to an agreement, partitioning actions can help settle disputes and set a course of action. Furthermore, one must be well-versed in Tennessee’s property and estate laws to guarantee that the deal is legal. All parties involved must take these legal factors into consideration if the complicated inherited property is to be managed effectively and if they want the best possible outcome.

Partition Actions: A Tool for Resolving Disputes

Partition actions serve as a valuable legal mechanism for addressing disputes among heirs who are unable to reach a consensus regarding the management of inherited property. If the heirs cannot reach a consensus on the decision to sell, retain, or manage the real estate, a partition action enables the court to step in and either divide or sell the property. Inherited property often entails various individuals with emotional and financial connections, leading to potential disagreements that can escalate rapidly. Collaborating with a lawyer well-versed in Tennessee property law can assist heirs in comprehending their rights and effectively navigating this court-supervised process.

Prior to initiating a partition action, it is advisable for heirs to engage in discussions with one another and explore the options of mediation or arbitration. These approaches can foster robust relationships, minimize legal expenses, and accelerate the resolution process. Partition proceedings may be lengthy and expensive, making it essential to comprehend the court’s role and potential outcomes to facilitate informed decision-making. Real estate can serve as a significant asset to inherit; however, in the absence of a mutual agreement, it may transform into a liability. Partition actions offer heirs a legal mechanism to ensure that their inherited interests are resolved equitably, allowing them to continue benefiting from these interests in compliance with state law.

Navigating Estate and Property Laws in Tennessee

To sell inherited real estate in Tennessee, you must first understand the state’s estate and property laws. The state’s legal framework ensures that decisions are fair and that heirs’ rights are protected, but it can also complicate issues like probate, estate administration, taxes, and property disputes. Probate administration is the process of validating a will, distributing assets, and settling any outstanding debts or tax obligations related to the estate, all of which must be completed before a property can be sold. Tennessee also provides expedited probate options for small or straightforward estates, allowing heirs to move through the process more quickly if eligible.

To complete a legal and timely sale, heirs must gather the necessary documentation confirming ownership interests and prepare for property title transfer once all legal requirements have been fulfilled. Legal counsel from an experienced estate attorney can help you avoid costly mistakes, shorten delays, and protect each heir’s interests. Understanding Tennessee’s probate and property laws enables heirs to reduce disputes, streamline the selling process, and maximize property value, ensuring that the inheritance is administered fairly and efficiently.

Practical Steps to Prepare Your Property for Sale

Selling inherited property in Tennessee requires a strategic approach. To begin, assessing the property’s condition is critical to determining its market potential and identifying areas for improvement. Compiling the necessary documents also helps to streamline the sale process, allowing for smoother transactions. Proper preparation not only addresses potential legal and financial issues but also increases the property’s appeal to prospective buyers. By focusing on these practical steps, heirs can better navigate the complexities of selling their inherited home, resulting in a profitable sale with fewer delays and disputes.

Assessing the Condition of the Inherited Property

Before you list your inherited property for sale, you should conduct a thorough inspection of its condition. This process entails inspecting both the interior and exterior of the property. Start by inspecting structural elements such as the foundation, roof, and walls. Deficiencies in these areas can have a significant impact on the property’s value and even turn prospective buyers off. Next, check the plumbing, electrical, and HVAC systems for functionality and potential issues. Professional inspections provide a thorough understanding of the necessary repairs and upgrades, making the property more appealing to buyers looking for a livable home.

Furthermore, cosmetic changes must not be overlooked. Simple improvements like new paint, landscaping, and minor renovations can significantly improve the home’s curb appeal. Making a good first impression is especially important in a competitive market like Knoxville. Consider the property’s market value in comparison to recently sold properties in the same price range. This diligence can help heirs make informed decisions about whether to invest in improvements before selling the property or to sell it as-is. Transparent communication with potential buyers about the home’s condition can foster trust and prevent future disputes.

Finally, keep in mind that any work done on the property may incur tax consequences. Improvements can raise the value of the home and thus the taxable portion of the sale proceeds. It is recommended that you consult an estate planning professional about the tax implications of any renovations. In the Tennessee real estate market, well-prepared homes attract higher offers, and focusing on assessments can help you maximize your property’s sale potential. Remember that a well-prepared home makes for a smooth transition into the seller’s market, increasing the chances of a successful sale.

Necessary Documents to Initiate the Sale

The sale of an inherited property in Tennessee requires meticulous documentation to ensure legality and transparency. Compiling these documents effectively sets the stage for a smooth transaction. The property deed is critical for establishing ownership and the legal right to sell. Ensure that this document accurately reflects the current ownership status after probate. Furthermore, the probate order or letters testamentary must be present to legally prove that the executor has the authority to manage the sale. These documents validate the legality of the sale, providing reassurance to potential buyers.

If a will exists, it is an important document. The clarity and legal standing of the will can influence how smoothly the sale goes. Sellers must ensure that any provisions relating to the property’s transfer or sale are properly documented and followed. Tennessee law requires disclosure documents outlining any defects or issues with the home to ensure transparency and compliance with legal requirements. This step protects all parties involved and can help to avoid future legal disputes by disclosing the full condition of the property.

Mortgage statements, tax receipts, and lien releases are all critical financial documents to keep. Accurate and up-to-date documents are required to provide a comprehensive financial picture of the property. They help to clarify any outstanding debts or obligations that must be paid before the sale. Engaging a legal professional can assist you in navigating these complexities and ensuring that all documents comply with Tennessee’s estate laws. Proper documentation is critical for a smooth and legal estate sale in Knoxville, which maximizes property value and asset transfer.

Benefits of Selling Your Inherited Property in Knoxville, TN

Heirs in Knoxville, Tennessee, can benefit significantly from selling inherited property. With high demand in the local real estate market, quick sales and competitive offers are common. Taking advantage of Knoxville’s market potential allows heirs to maximize the property’s value, turning a sentimental asset into a valuable source of income. Selling can also lower long-term maintenance costs and help prevent family disagreements over property management. By understanding these opportunities, heirs are better prepared to evaluate their estate’s worth and make informed decisions, especially when working with Southern Sky Home Buyers in Knoxville to navigate the selling process efficiently.

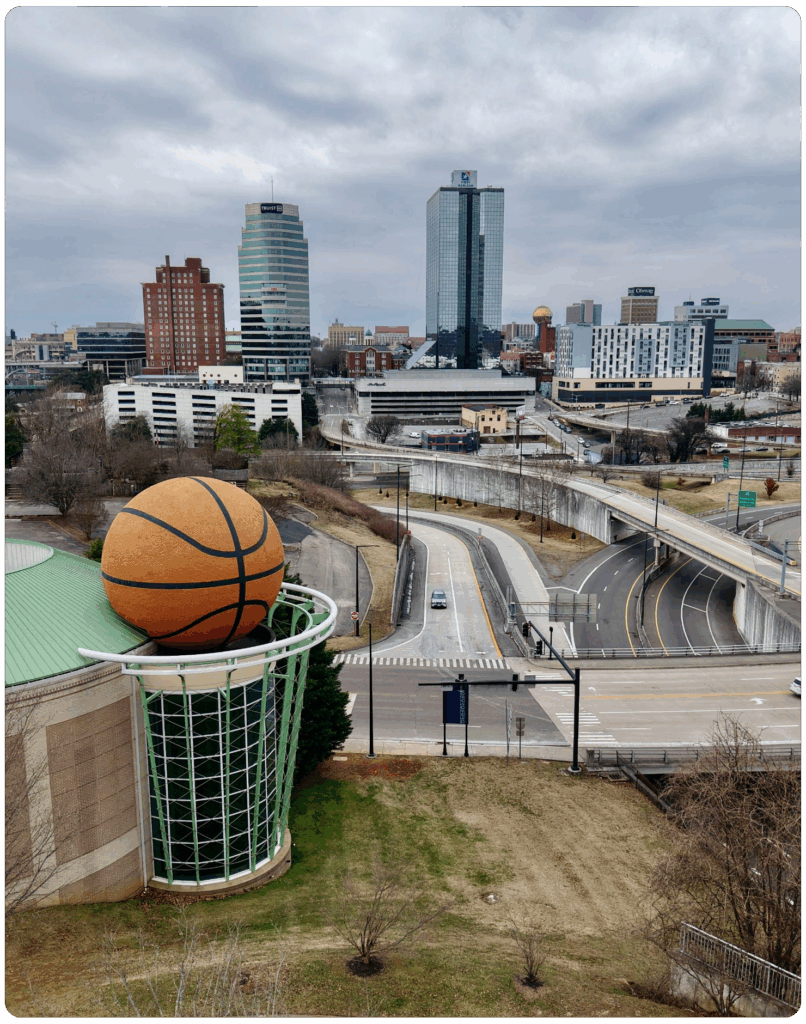

Why Knoxville is an Attractive Market for Buyers

Living in a growing and competitive real estate market makes Knoxville, Tennessee, an attractive place to call home. Both investors and first-time buyers are drawn to the area because it offers the perfect mix of city convenience and rural appeal. With steady demand for housing, inherited property in Knoxville has strong potential to sell quickly and for a favorable price. The city also offers a wide variety of home styles, from modern builds to historic houses, appealing to different buyer lifestyles and preferences. Given these favorable conditions and the availability of cash home buyers in Knoxville and surrounding Tennessee cities, heirs may want to carefully consider selling rather than holding onto inherited property.

Real estate is a good investment in Knoxville because of the city’s steady economy. The city’s economy is robust because of its many educational institutions, companies, and cultural attractions. Because of this stability, the area’s finances remain stable, and there will always be people looking to buy or invest in the area. The active market is a great opportunity for heirs to sell their property for a higher price, relieving them of future responsibilities such as maintenance and tax payments. Taking advantage of inherited estates is a breeze in Knoxville’s current market. Property values tend to rise over time, which is fantastic news for homeowners.

Knoxville is attractive for more reasons than just its strong economy. The city is known for its beautiful scenery, family-friendly neighborhoods, and a lot of fun things to do, which are all big reasons why people want to buy homes there. By selling in a market where buyers want a good quality of life and the chance to make money, heirs can get a lot of money for their inherited property. Knoxville is a smart place to sell inherited real estate because it has a strong market and a good quality of life. This encourages heirs to make smart, proactive choices about their property assets.

Maximizing the Value of Your Estate

To increase the value of an inherited estate in Knoxville, you must engage in strategic planning and have a thorough understanding of market dynamics. An effective strategy consists of improving the property’s curb appeal through targeted upgrades and maintenance efforts. Basic improvements such as updated landscaping, new paint, or minor renovations can significantly increase the market value of a home. Maintaining the property in excellent condition and making it visually appealing to potential buyers increases the selling price and speeds up the transaction process. Heirs can capitalize on Knoxville’s competitive market by matching their property to current buyer demands, resulting in a profitable and timely sale.

Furthermore, understanding local market trends is critical for obtaining the best value for your inherited property. Heirs are advised to conduct a market analysis to determine the most advantageous selling price, taking into account factors such as location, amenities, and current demand in Knoxville. Working with specialists who understand the Knoxville market can provide valuable insights into the best presentation and pricing strategies to increase buyer interest and offers. This proactive method of property valuation ensures that the estate’s full value is realized during any sale transaction.

Heirs must consider the financial implications, such as tax liabilities and potential capital gains, which can have an impact on the estate’s overall profitability. Working with financial advisors who understand Tennessee’s tax laws can help you navigate these complexities and ensure that the financial aspects of the sale are optimized. Heirs can improve the selling process by gathering detailed documentation and gaining insight into the property’s condition. This will reduce delays and conflicts. Adopting these strategies enables heirs to effectively capitalize on Knoxville’s thriving market, exposing the property’s potential and increasing its value.

FAQs:

What is heir property, and why is it complicated to sell?

Heir property refers to real estate inherited without a will, resulting in shared ownership among multiple heirs. Each heir has an undivided interest, necessitating unanimous consent for sales, which can lead to potential disputes and complicate the sale process.

How can partition actions assist in selling heir property in Tennessee?

Partition actions allow courts to oversee the sale or division of heir property when heirs cannot agree on selling. This legal remedy ensures a fair resolution, facilitating the sale process despite disagreements among heirs.

Why is understanding probate essential in Tennessee for selling inherited property?

Navigating probate is crucial, as it involves validating the decedent’s will and managing their debts and taxes. Understanding probate procedures helps avoid delays and ensures compliance with Tennessee’s estate laws for a smooth property sale.

What are some legal considerations when selling inherited property in Knoxville?

Legal considerations include obtaining court approval if required, resolving any outstanding debts or taxes, and preparing necessary documentation. Engaging with legal experts familiar with Tennessee property laws ensures compliance and smooth transactions.

How do Knoxville’s real estate market dynamics benefit heirs selling inherited property?

Knoxville’s thriving real estate market offers a blend of urban and rural attractions, attracting a diverse range of buyers. Heirs can benefit from quick sales and competitive offers, maximizing estate value by aligning property characteristics with market demands.

Helpful Knoxville Blog Articles

- Inherited House with Sibling in Knoxville, TN

- Can Heir Property Be Sold in Knoxville, TN

- Can You Sell a House As-Is Without Inspection in Knoxville, TN

- Quick Tips to Sell Distressed Properties in Knoxville, TN

- Selling a House with Pets in Knoxville, TN

- Should I Replace My Roof Before I Sell My House in Knoxville, TN?

- Selling a Home for a Loss in Knoxville, TN

- How Much Equity Do I Need to Sell My House in Knoxville, TN

- Selling a House with Solar Panels in Knoxville, TN

- Selling an Old House in Knoxville, TN